Home Improvement Tax Deduction 2025. Your home improvement tax deductions happen when: Learn the rules and guidelines of home improvement loans in our comprehensive guide.

Discover if your home improvement expenses are tax deductible. The residential clean energy credit equals 30% of the costs of new, qualified clean energy property for your home installed anytime from 2025.

The energy efficient home improvement credit for 2025 is 30% of eligible expenses up to a maximum of $3,200.

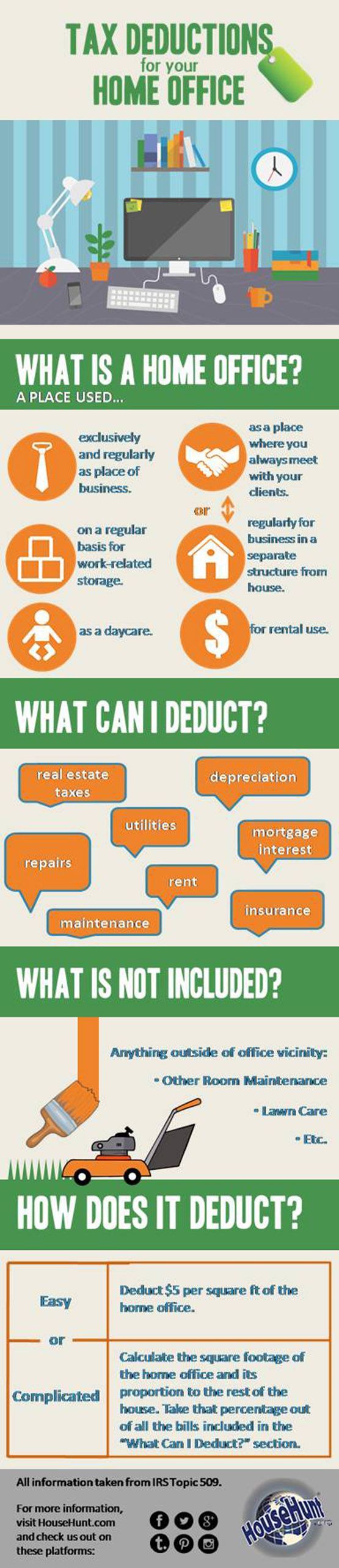

7 Home Improvement Tax Deductions for Your House YouTube, If all the math above seems like a pain to sort through, you can take the simplified home office deduction instead. If your medical improvement costs exceed 7.5% of your gross annual income, you’ll qualify.

![7 Home Improvement Tax Deductions [INFOGRAPHIC]](https://help.taxreliefcenter.org/wp-content/uploads/2018/07/Tax-Relief-Center-7-Home-Improvement-Tax-Deductions-For-Your-House-FEATURED.jpg)

7 Home Improvement Tax Deductions [INFOGRAPHIC], There are certain situations where you may be eligible for tax. The energy efficient home improvement credit covers lots of items, including windows and doors, insulation, central a/c, biomass stoves and electric heat pumps.

Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, For joint filers, the deduction spans interest on loans. If all the math above seems like a pain to sort through, you can take the simplified home office deduction instead.

![7 Home Improvement Tax Deductions [INFOGRAPHIC] [Video] [Video] Tax](https://i.pinimg.com/736x/24/91/0b/24910b36cb01204858c46fd5ae58d17c.jpg)

7 Home Improvement Tax Deductions [INFOGRAPHIC] [Video] [Video] Tax, The energy efficient home improvement credit for 2025 is 30% of eligible expenses up to a maximum of $3,200. 2025, 2025, 2025, 2025, deductible, deduction, home, improvements, tax.

TaxDeductible Home Improvements What You Should Know This Year Tax, In some cases, home improvements can result in tax deductions. For the 2025 tax year, multiply $5 by the area of your home.

New Standard Deductions for 2025 Taxes Marketplace Homes Press Release, Though that’s true sometimes, not all home improvements qualify for a. 2025, 2025, 2025, 2025, deductible, deduction, home, improvements, tax.

Tax Deductions for Your Home Office Visual.ly, Discover if your home improvement expenses are tax deductible. The energy efficient home improvement credit (eehic) was introduced under the inflation reduction act (ira) of 2025.

Tax Deductions on Home Improvement Projects TaxAct Blog, You might have heard you can claim home improvements on your tax returns to save money. You owned the home in 2025 for 243 days (may 3 to december 31), so you can take a tax deduction on your 2025 return of $946 [(243 ÷ 365) × $1,425] paid in 2025 for 2025.

What Is The Standard Deduction For 2025 Grata Brittaney, Form 1040 + limited credits only. If your medical improvement costs exceed 7.5% of your gross annual income, you’ll qualify.

![7 Home Improvement Tax Deductions [INFOGRAPHIC] Tax deductions](https://i.pinimg.com/originals/bb/c7/4e/bbc74ee927d067f43bbaf4252e12eb28.jpg)

7 Home Improvement Tax Deductions [INFOGRAPHIC] Tax deductions, For the 2025 tax year, multiply $5 by the area of your home. Find out what you can deduct for tax year 2025

You owned the home in 2025 for 243 days (may 3 to december 31), so you can take a tax deduction on your 2025 return of $946 [(243 ÷ 365) × $1,425] paid in 2025 for 2025.